Inflation is weakening, what’s next?

The real estate market has been experiencing some fluctuations lately, and the latest news from the Federal Reserve has only stirred up more questions. Inflation has been weakening, but what does that mean for the future of the market?

The Federal Reserve has been hiking interest rates in an effort to curb inflation and prevent the economy from overheating. And it seems to be working: inflation has been slowing down in recent months. However, this success is creating a dilemma for the Feds. The same measures that are keeping inflation in check could also be hurting the economy.

As interest rates rise, borrowing becomes more expensive, which can slow down economic growth. This can be especially problematic for the real estate market, where rising interest rates can make it harder for buyers to afford homes and for sellers to find buyers.

So what's next for the real estate market? It's hard to say for certain, but there are a few things to keep in mind.

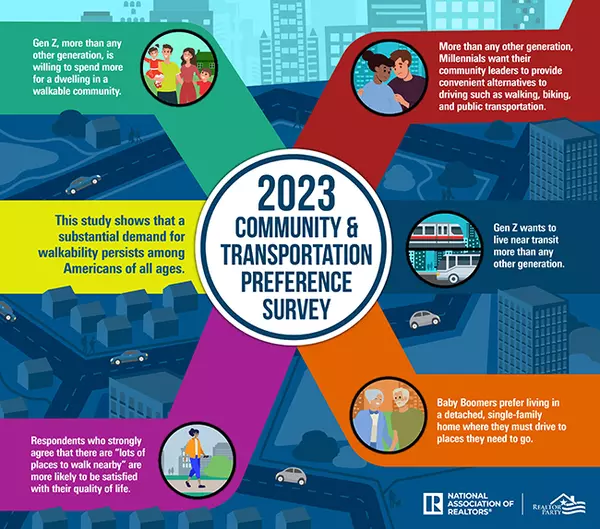

First, it's important to remember that the real estate market is always changing. Even if inflation continues to weaken, there are other factors that can impact the market, such as job growth, population growth, and changes in consumer preferences.

Second, investing in real estate can still be a wise choice, even in uncertain times. Real estate is a tangible asset that can provide steady income and long-term appreciation. And with interest rates still relatively low, it's a good time to lock in a mortgage rate if you're looking to buy a property.

Finally, it's worth keeping an eye on the Fed's actions and any future rate hikes. These moves will have a significant impact on the real estate market, so it's important to stay informed and be prepared for any changes.

In conclusion, while inflation may be weakening, the real estate market is still full of opportunities. By staying informed and being aware of the latest market trends, investors and buyers alike can make smart decisions that will pay off in the long run.

Recent Posts

Quick Response Form